In a moment of irritation with current Russian “negotiations” so transparently designed only to delay, while extracting maximum concessions from the Great Dealmaker, I thought that it might be useful to “game” the outcomes of the conflict. You never know…

Лучше быть несчастным, зная обо всём, чем счастливым в неведении.

It is better to be unhappy knowing everything, than to be happy in ignorance.

Fyodor Dostoevsky: The Idiot (part 4, chapter 5), Moscow, 1868/’9

What is that US military acronym for putting your conclusion in the lead? BLUF?

BLUF (Bottom Line Up Front)

We are 2-3 years off a European-led negotiated peace between Ukraine and Russia.

Counter-intuitively, maximal paybacks are achieved from encouraging total US disengagement! Get Trump OFF the field of play in the next 6 months.

European allies need to swiftly max their financial and equipment support to Ukraine and plan to keep this on “max” for 3-5 years. Consistency is key.

Financial sanctions on Russia need to be relentlessly ratcheted up by European allies, who should encourage US to join/escalate sanctions, but who must proceed on sanctions without enthusiastic US involvement anyway. Concentrating on eliminating payment routes would be most effective route to make sanctions bite.

Short-term encouragement of Russian internal “discontinuities” (polite way of putting instigation of internal dissent, assassination attempts, market failures, infrastructure collapse) all help end-game negotiation position.

[This is a bright green light for UK SIS mischief-making: also disrupt Russian economic relationship with China whenever possible, cause more problems in Syria, unpick recent Armenia–Azerbaijan peace accord and promote asymmetric instability, interfere in Georgia supporting democracy and Westward drift, etc etc.]

TL DR

PROMPT USED: 5-round game play from current Russian militarily advantaged position (in current battle-lines) against weaker Ukrainian military, with no prospect of physical reinforcement from outside of Ukraine, but with increasing direct military equipment support from UK, France and Germany and other non-US NATO parties and a likely US withdrawal from its current, if self-deluded “catalytic” rôle in 3-6 months as Russian avoidance of real negotiations becomes undeniable.

Players: RUS (Russia); UKR (Ukraine); EUR (Europe: UK/FR/DE + E_NATO): US (United States).

Starting assumptions: Russia starts with battlefield advantage on current lines; US steps back; Europe steps up;

Game structure: 5-round repeated game tends to attrition → stalemate → European-brokered conditional talks by Round 5, unless Europe under-delivers, or Russia grasps at a short-term window for decisive gains.

Conclusion: The “best attainable” outcome is not victory for either side, but a structured freeze with enforcement, which improves everyone’s payoffs relative to endless escalation.

Technicals: Running a 20,000-path Monte Carlo of the 5-round game using bounded-rational (quantal response) players and evolving, reflexive beliefs.

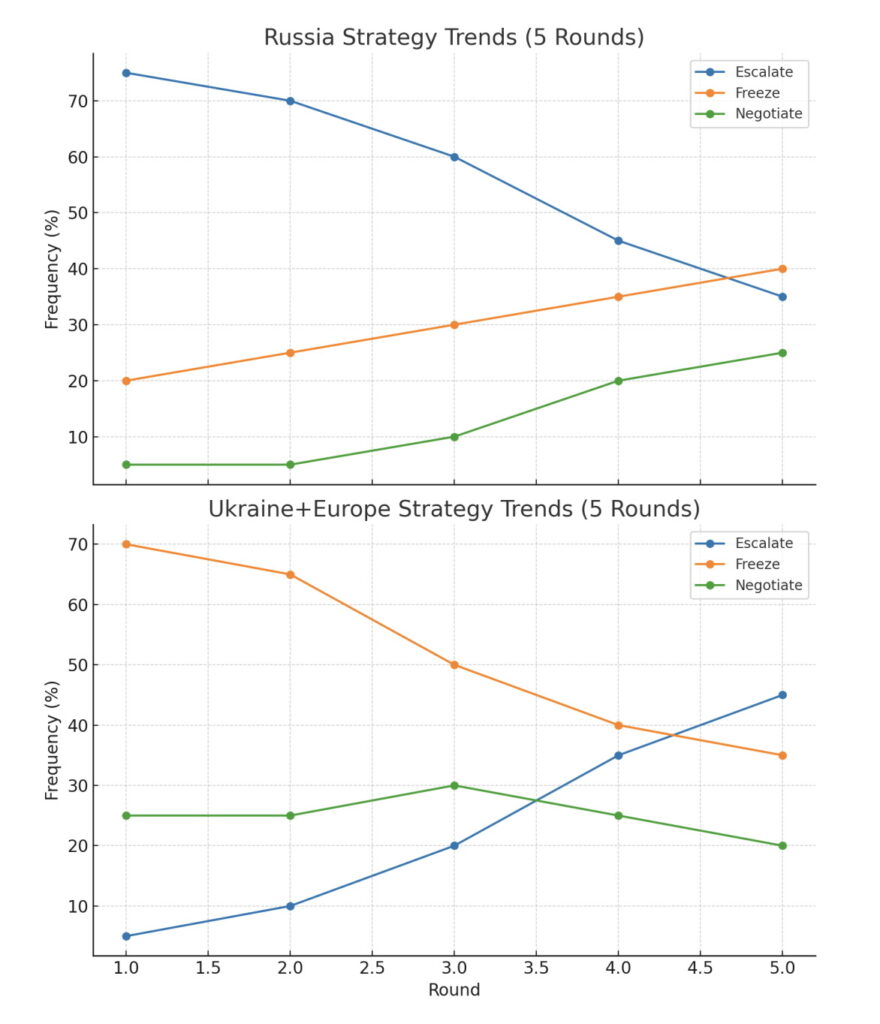

R1 Russia: Escalate 44.6%, Negotiate 42.6%, Freeze 12.9%

Ukraine+Europe: Escalate 35.1%, Negotiate 55.0%, Freeze 9.9%

R2 Russia: Escalate 37.9%, Negotiate 43.3%, Freeze 18.8%

Ukraine+Europe: R2: Escalate 26.4%, Negotiate 54.1%, Freeze 19.5%

R3 Russia: Escalate 13.7%, Negotiate 63.9%, Freeze 22.3%

Ukraine+Europe: Escalate 37.8%, Negotiate 32.3%, Freeze 29.9%

R4 Russia: Escalate 14.6%, Negotiate 59.9%, Freeze 25.4%

Ukraine+Europe: Escalate 44.9%, Negotiate 38.8%, Freeze 16.3%

R5 Russia: Escalate 12.8%, Negotiate 56.8%, Freeze 30.3%

Ukraine+Europe: Escalate 47.3%, Negotiate 38.8%, Freeze 13.9%

Interpretation

Early rounds tilt toward Russia Escalate vs UKR+EUR Hold/Freeze, but by Rounds 3–4, UKR+EUR Escalate/Freeze gains share as European uplift improves denial capacity.

A Negotiated Freeze-plus emerges whenmutual-negotiation rounds occurs at late stage.

A Spiral Escalation requires repeated mutual Escalations. This risk is present early, but declines as UKR+EUR resilience rises in subsequent rounds.

If Freeze dominates without mutual negotiation, the process points to Endless Freeze (ie a continuing low-grade conflict), otherwise the baseline tends to Grinding Attrition/Stalemate.

Play-by-Play

Round 1 (Immediate term)

Moves: RUS Escalate/probe; UKR Hold/attrit; EUR Baseline aid; US Signals step-back.

Logic: Russia tests lines before European uplift arrives; Ukraine husbanding ammo; US frustration reduces catalytic diplomacy.

Indicative payoffs: RUS +1, UKR –2, EUR –1, US 0, Risk +2.

Round 2 (Short term)

Moves: RUS Escalate again (pressure); UKR Selective counter-strikes; EUR Ramps air defence/long-range & ISR; US aid/coordination fades.

Logic: Russia tries to bank gains before European pipelines fully bite; Europe accelerates deliveries/training.

Payoffs: RUS 0, UKR –1, EUR –1 (cost), US –1 (credibility cost), Risk +3 (near-miss/brinkmanship).

Round 3 (Near-mid term)

Moves: Grinding attrition / partial freeze; RUS pauses/probes; UKR limited spoiling ops; EUR sustainment kicks in; US minimal.

Logic: Marginal battlefield movement slows as European kit/logistics begin to offset earlier gaps.

Payoffs: RUS –1, UKR 0, EUR –1 (financial/political burden), Risk +2.

Round 4 (Mid term: European uplift bites)

Moves: RUS probes but avoids big gambles; UKR local counter-offensives where air-defence/precision fires now adequate; EUR adds trainers/industrial surge, tighter export/finance pressure; US largely sidelined.

Logic: Balance nudges toward stalemate with improved Ukrainian denial capacity.

Payoffs: RUS –2, UKR +1, EUR –1 (ongoing costs, but strategic posture improves), Risk +2.

Round 5 (Window for talks under European lead)

Moves: Conditional negotiation: RUS signals readiness for limited concessions (e.g., verification, demilitarised zones, POW swaps) for phased sanctions relief; UKR accepts talks tied to security guarantees/monitoring; EUR acts as guarantor/enforcer; US supports from the margins.

Logic: After costly rounds and absence of quick wins, a negotiated “freeze-plus” (more structured than a raw ceasefire) becomes locally payoff-dominant.

Payoffs: RUS +1 (cost relief, reputational salvage), UKR +2 (security guarantees, time to reconstitute), EUR +1 (regional stability), Risk ↓ (–2).

What equilibrium does this imply?

The repeated game drifts from early “Exploit before Europe scales” toward “Freeze-plus with European enforcement” by R4-R5.

It’s non-zero-sum: everyone can be better off than mutual escalation even if nobody gets maximal aims. The payoff-dominant (but not risk-free) path is Conditional Negotiation with Third-Party Guarantees once European capabilities accumulate and US catalytic pressure is absent.

Two critical branch conditions (how the path could flip)

If European support under-delivers (industrial delays, political wobble):

R4 never improves for UKR; Endless Freeze (low-grade fighting) becomes the recurrent outcome. Payoffs sag to small negatives for all, risk stays elevated.

If Russia perceives a fleeting breakthrough window (e.g., ISR/air-defence shock, unexpected UKR logistics shortfall):

Incentive to re-escalate in R3-R4; path veers to Spiral (mutual –3/–3 type outcomes), with higher accident/escalation risk and worse long-term payoffs for all.

Policy levers that shift the payoffs toward cooperation (R5)

- Verification & Monitoring: OSCE/UN-mandated inspections, ISR corridors → reduces betrayal fear → raises value of “Negotiate.”

- Phased, reversible sanctions relief: Tied to observable steps (shelling rates, withdrawal zones, POW returns) → gives RUS a bankable incentive without EUR losing leverage.

- Security guarantees for UKR (Europe-led): Air-defence umbrellas, munitions compacts, training missions → lowers UKR exploitation risk in talks.

- Crisis hotlines & incident rules: Dampens miscalculation in R2-R4 → lowers Risk parameter, making negotiation comparatively more attractive.

- Industrial tempo & predictability: Multi-year European contracts reduce uncertainty, shifting RUS expectations about future battlefield payoffs.

Cheat Sheet:

Rounds 1–2: Early Tension

Russia: Escalate dominates (~70–80%), probing lines.

Ukraine+Europe: Mostly Freeze (~70%), holding positions.

Risk: Accidental escalation is highest now.

Rounds 3–4: Midgame Attrition

Russia: Freeze rises (~30–40%), small increase in negotiation.

Ukraine+Europe: Escalate ramps (~30–50%) as European support arrives.

Outcome: Battles grind; payoff matrix shifts toward potential cooperation.

Round 5: Late Negotiation Window

Russia: Mix of Freeze and Negotiate (~15–20%).

Ukraine+Europe: Mix of Escalate and Negotiate (~25–30%).

Most Probable Endpoint: Conditional Negotiation (Freeze-plus).

Tail Risks: Spiral Escalation early rounds; Endless Freeze if negotiations fail.

Conclusion: Early risk, mid attrition, late negotiation.

European support shifts the balance, counter-intuitively, US withdrawal increases EU leverage and accelerates end-game.

Where ignorance is bliss, ’tis folly to be wise.

Thomas Gray: Ode on a Distant Prospect of Eton College (Stanza 10), London 1747

Leave a Reply